An online course with Malin Havefjäll

Former Tax Office employee and accounting economist with 20 years of experience in entrepreneurship

Report, file and pay VAT

Report the VAT quick and easy

9 lessons

Learn how to report VAT. From the time you receive or write an invoice until you have paid the Tax Agency.

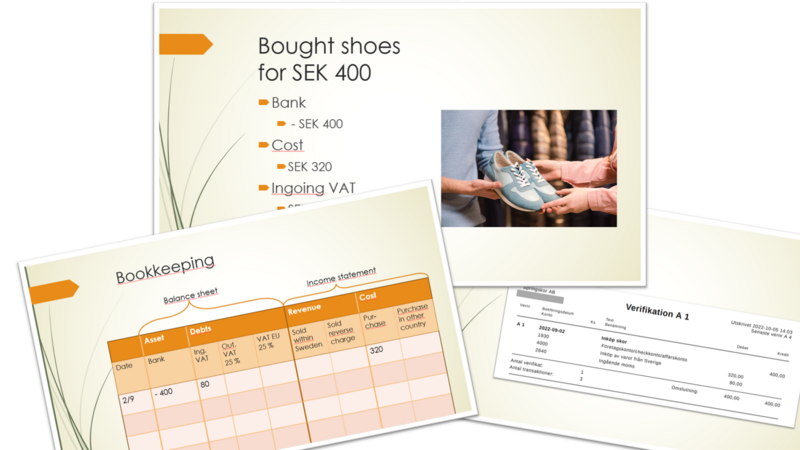

Practical examples

Learn how to practically handle things you buy and sell in the accounting - everything so that you can easily get the numbers for the VAT declaration.

When and where you want

Take the online course at your own pace, as many times as you want and when it suits you.

Lessons

Introduction

Welcome to the course! In the introduction, Malin tells you what you will learn during the course and how the lessons are structured.

Lesson 1

VAT

You will learn what VAT is and important words to know, so that you can tell the difference between "apples and pears" when we deal with the different numbers.

| 15 min |

Lesson 2

Administration

You will learn what you need to do continuously during the year to be able to report the VAT in the VAT return.

| 15 min |

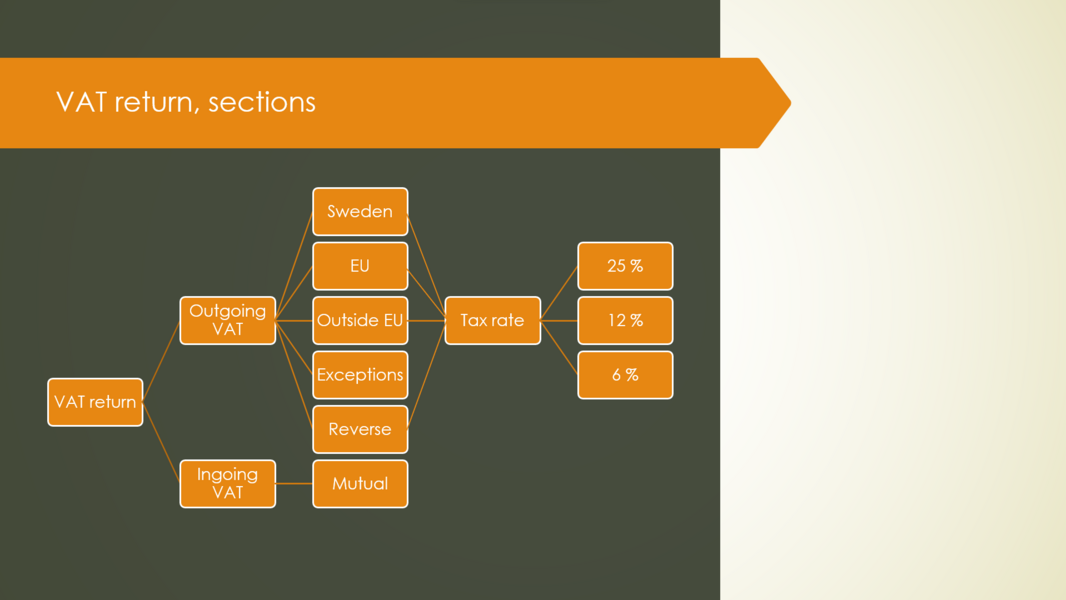

Lesson 3

Structure

You will learn the connection between the bookkeeping and the VAT return, so that you can quickly and easily get the numbers when it is time to file.

| 17 min |

Lesson 4

Accounting period

You will learn when to file the VAT in the VAT return to the Swedish Tax Agency, based on the accounting method and period you have chosen.

| 10 min |

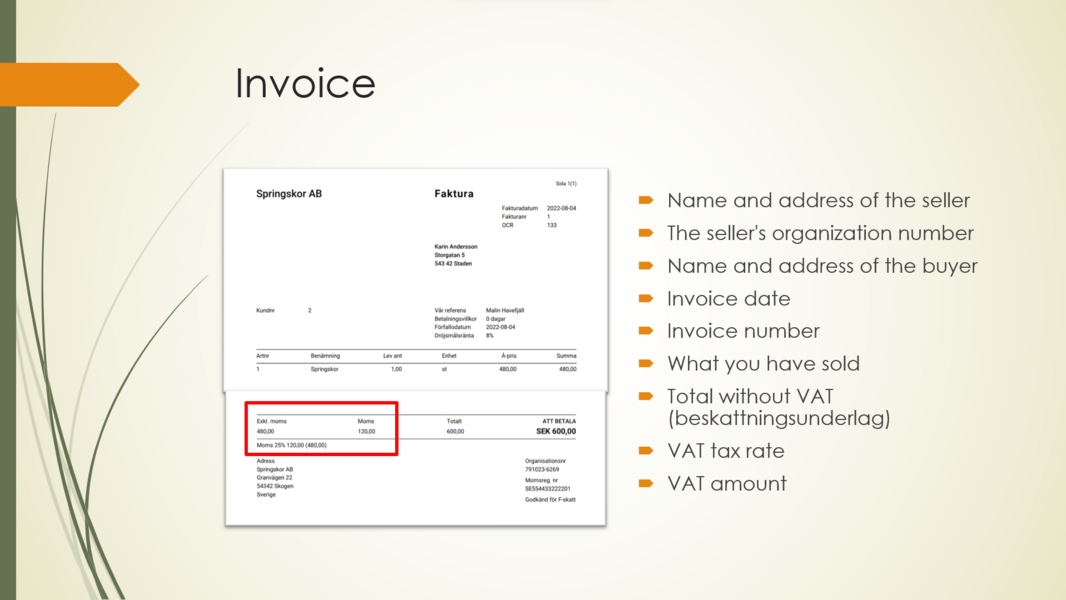

Lesson 5

Proof of evidence

You will learn what documents you must have in your accounting in order to get VAT money back from the state.

| 15 min |

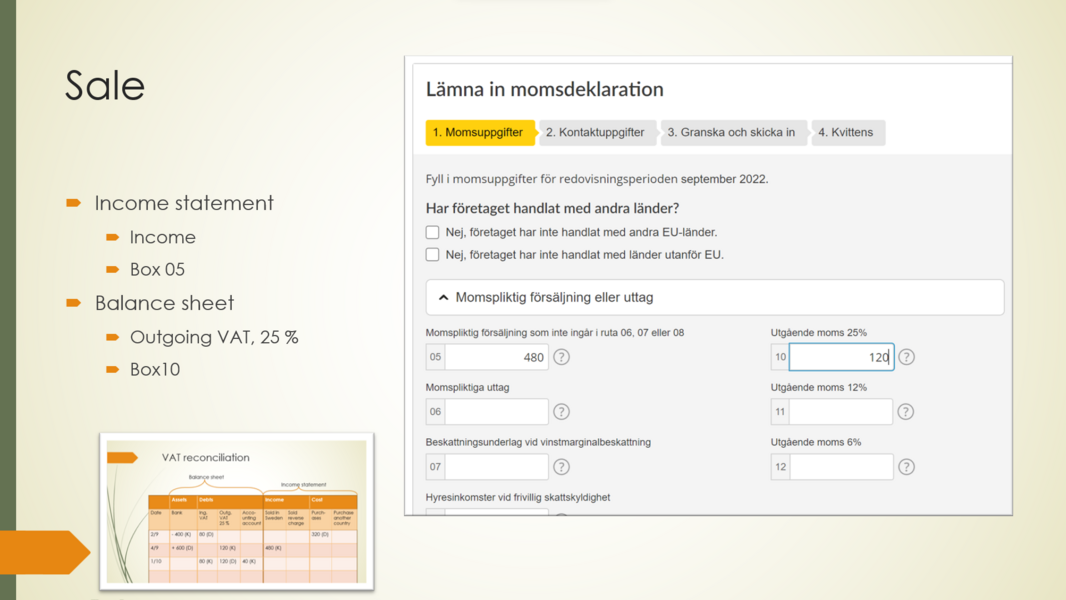

Lesson 6

Report

You will learn step by step how to fill in the VAT return and where to find the numbers in your accounting, so that you can do it yourself.

| 23 min |

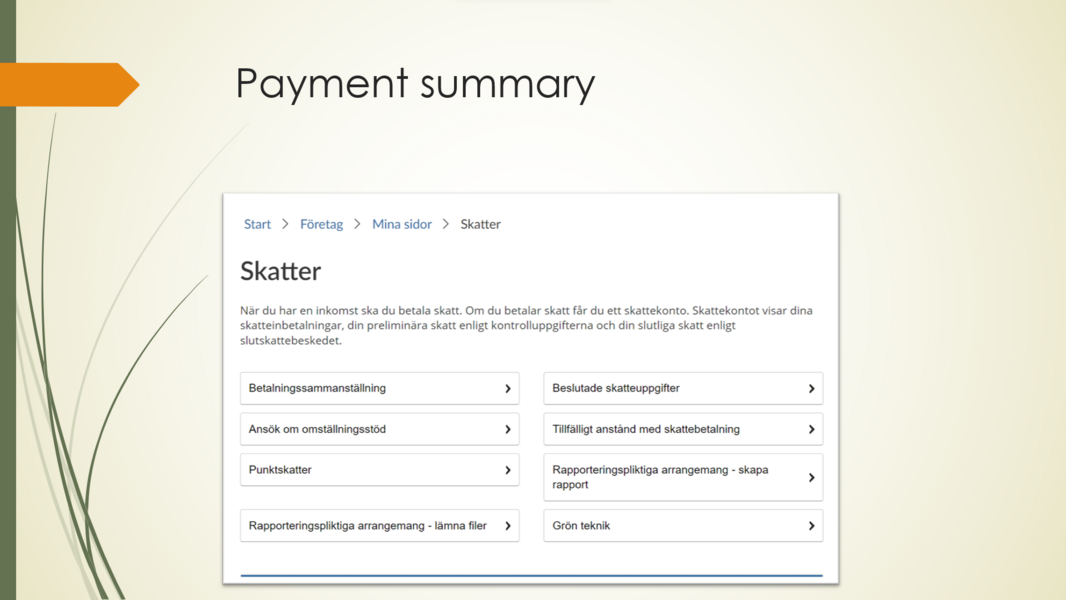

Lesson 7

Pay

You will learn where and how to find the information at the Tax Agency about what you have to pay, so that you do not miss paying for example preliminary tax in connection with VAT.

| 8 min |

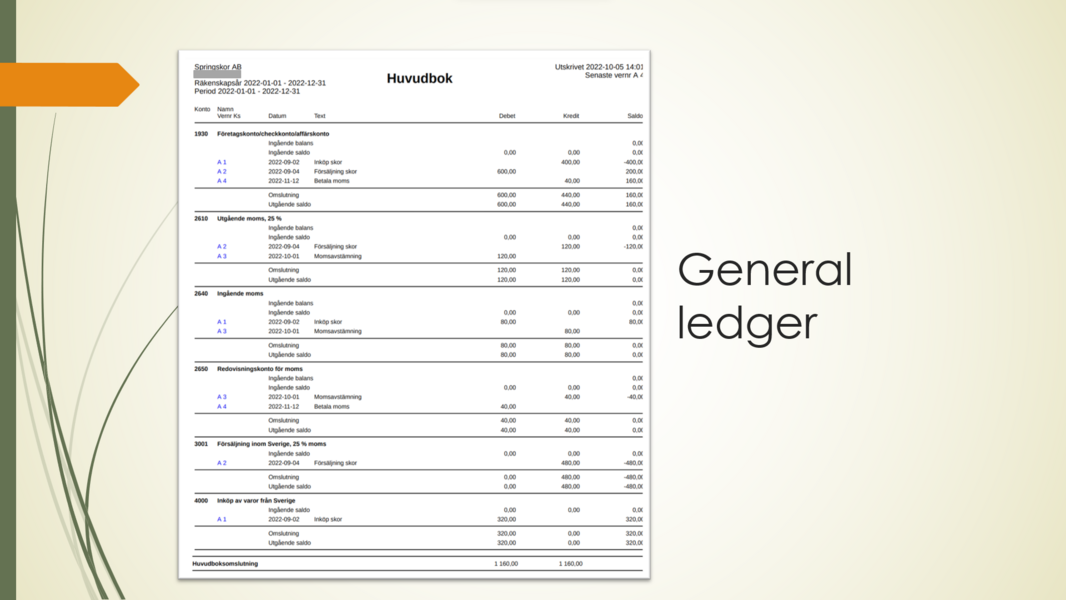

Lesson 8

Book

You will learn how to book the VAT you have paid to the Swedish Tax Agency and we will go through how the bookkeeping from purchases and sales to accounting and VAT return looks like in your bookkeeping.

| 10 min | Quiz |

About Malin Havefjäll

Hello! My name is Malin Havefjäll and I am the former tax accountant who has now changed sides.

I have always been involved in the smaller companies and above all the entrepreneur behind them.

I started my professional life on and behind the scenes and via my own company and later university studies in accounting and finance, I stopped at the Swedish Tax Agency for 10 years, before I found a home in Företagshjälpen Havefjäll.

I have compiled all my experience and knowledge that I have built up over 20 years from entrepreneurs and their everyday life in this course.

I hope you will enjoy the course and that afterwards you will have a new, deeper understanding of VAT!

Take your accounting knowledge to the next level level!